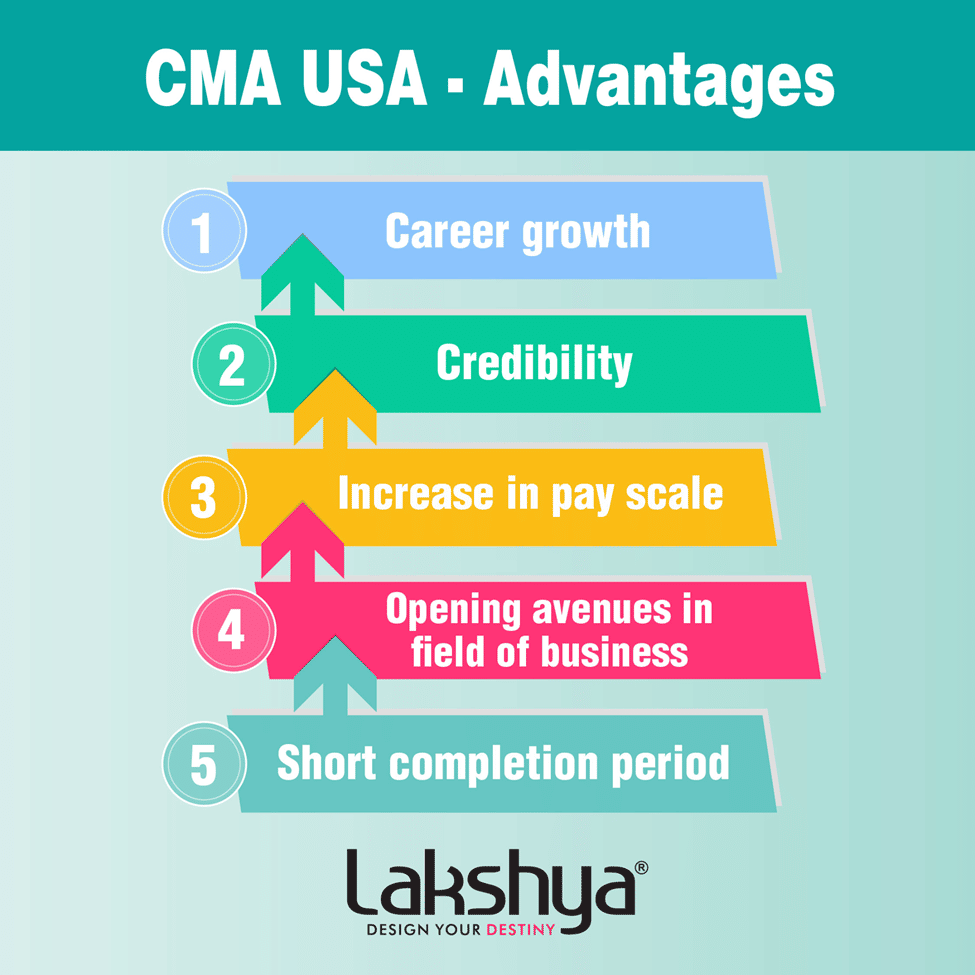

If you’re a young or aspiring accountant with big career goals, it’s only natural to look for ways to take your career to the next level and increase your earning potential. Thankfully, there’s no better way to do so than becoming a Certified Management Accountant (CMA)

Certified accountants are in huge demand in the job market. The U.S. Bureau of Labor Statistics projects a 6% growth in the demand for accountants and auditors from 2018 to 2028. Even in a tight job market, becoming a CMA will help you stand out in the crowd.

So, what does it take to become a CMA?

It might seem like an intimidating process, but getting your CMA is just like anything else. It becomes much easier once you break it down into simple, actionable steps. In this article, we break down each and every step you’ll need to take to become a CMA and get on with your career.

Without further ado, let’s dive in!

Contents

- 1 10 Simple Steps to Becoming a Certified Management Accountant (CMA)

- 1.1 1) Learn accounting fundamentals

- 1.2 2) Become an IMA member and Enroll in the CMA Program

- 1.3 3) Meet or complete the CMA educational requirements

- 1.4 4) Select a CMA review course

- 1.5 5) Register for the CMA exam and pay exam fees

- 1.6 6) Study for and pass the CMA exam

- 1.7 7) Fulfill your CMA experience requirements

- 1.8 8) Consent to abide by the IMA Statement of Ethical Professional Practice

- 1.9 9) Complete the Annual CPE Requirements

- 1.10 10) Maintain a good track record for renewing your license

- 2 Bottom Line

10 Simple Steps to Becoming a Certified Management Accountant (CMA)

The CMA credential is becoming increasingly popular among accounting and finance professionals. Certified Management Accountants (CMAs) are in high demand because they help business owners manage and oversee increasingly complex and diverse businesses.

However, obtaining your CMA can be a long and challenging process. Thankfully, we’ve compiled 11 simple steps on how to become CMA to make your CMA journey easier and faster.

Let’s begin with the first step:

1) Learn accounting fundamentals

The first you’ll need to do is to learn and understand your accounting fundamentals. This is the foundation upon which everything else will depend on.

At a minimum, you should understand the ins and outs of financial statements, financial ratios and other important concepts like forecasting.

You can learn accounting fundamentals by completing college classes, reading books, or working with a private tutor.

2) Become an IMA member and Enroll in the CMA Program

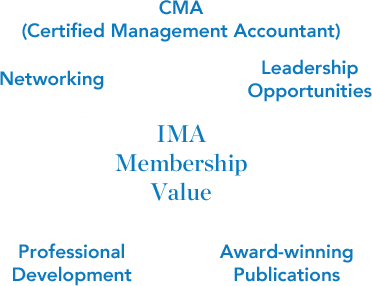

The Institute of Management Accountants (IMA) is the world’s leading organization that empowers management accounting and finance professionals to drive business performance.

IMA membership provides access to exclusive resources, networking opportunities, and the ability to stay ahead of the curve with cutting-edge research and publications. Plus, IMA members can take advantage of discounts on CMA exam prep courses and materials.

There are five membership options you can choose from, namely:

- Educator

- Professional

- Employer Program

- 1-Year Student

- 2-Year Student

What steps should you take to become an IMA Member?:

- Visit the IMA website.

- Click Join Now in the upper right corner of any page.

- Fill out your contact information in the form provided, click submit payment details, or select your payment option at checkout.

- Choose which category you want to join.

- Review your account summary and then click Finish at the bottom of the screen.

3) Meet or complete the CMA educational requirements

To meet the CMA educational requirements, you’ll need to complete a four-year bachelor’s degree from an accredited institution in any country.

Students studying at unaccredited institutions can go through an independent agency to get their degrees evaluated. Alternatively, several professional certificates such as the Chartered Financial Analyst (CFA) certification and the Certified Internal Auditor (CIA) certification can serve as a substitute for a college degree.

Many candidates meet these requirements before sitting for the CMA exam, but it’s not required.

That’s right, you can enroll in the CMA program and sit for the CMA exam without completing the CMA educational requirements. However, you must complete the educational requirements and send in your transcripts within 7 years of passing the exam.

4) Select a CMA review course

One of the most important steps to become a CMA is selecting the right CMA review course.

Make sure you choose a course that’s comprehensive, fits your learning style and covers all the topics you need to know for the exam. Also. make sure the course stays up-to-date with the latest exam specifications.

Check out our expert CMA course reviews and CMA discounts to help you find the right course at the right price.

5) Register for the CMA exam and pay exam fees

The next step is to register for the CMA exam and pay the required fees. Exam fees vary based on the IMA membership level you choose.

You can register for the exam online through the Institute of Management Accountants (IMA) website.

You can sit for the CMA exam during any of the following three testing windows:

- January-February;

- May-June, and

- September-October;

The IMA also offers several different payment options, including a payment plan.

Once you’ve completed your exam registration process, you will receive an email confirmation. You then must confirm your registration with the IMA by providing the necessary details like your name and address.

6) Study for and pass the CMA exam

Once you have registered for the exam, the next step is to study diligently and pass the CMA exam.

Need some help? Stop by our CMA learning center for helpful tips and strategies!

The CMA exam is administered by the IMA, consists of two parts:

- Part 1, which covers financial reporting, planning, performance, and control; and

- Part 2, which covers various financial decision-making topics

Each part includes 125 multiple-choice questions divided into five sections. The total time allotted for each part is three hours.

You may retake any exam part until an overall passing grade is achieved. However, you must pass both parts within a 3-year window of your initial exam enrollment, otherwise you’ll lose credit for any passed exam parts and need to repay the entrance fee.

7) Fulfill your CMA experience requirements

In order to become a CMA, you also must meet the IMA’s CMA experience requirement.

ICMA requires CMA students to have at least two years of full-time professional experience in management accounting or financial management. You can gain this experience by working in public accounting, corporate accounting, government, or not-for-profit organizations.

You can meet this CMA experience requirement by working part-time for two years and at least 20 hours every week. Hence, two years of part-time work can substitute for one year of full-time work.

Similar to the CMA educational requirements, the CMA experience requirement can be met up to 7 years after passing the CMA exam.

8) Consent to abide by the IMA Statement of Ethical Professional Practice

You must complete a few steps after passing the CMA exam before claiming your certification. One of these entails reading the IMA Statement of Ethical Professional Practice and consenting to abide by it.

Remember, becoming a CMA is about more than just passing an exam. The IMA demands that its members adhere to a code of excellence and moral ethics, as it helps ensure the integrity and value of the credential for all of its members.

You have to live up to your reputation of being a CMA. After all, you have worked hard for it!

9) Complete the Annual CPE Requirements

Each year, CMA members must complete 30 hours of continuing education, two of which must cover the subject of ethics.

CPE topics must be relevant to a management accountant’s or finance manager’s professional development and related to the company’s needs to qualify for CPE credit.

If you pass the CMA exam mid-year, you have until the following year to begin fulfilling the CPE requirement. However, you’re allowed to roll over up to 10 CPE hours to the following reporting year, so you can start preparing for it now if you’d like.

Employers, educational institutions, commercial organizations, and professional and trade organizations all offer CPE programs. Additionally, acceptable CPE courses can be found online or in seminars, technical meetings, workshops, college courses, and self-study guides.

A link to more details about the IMA’s CPE guidelines is available in the CMA Handbook.

10) Maintain a good track record for renewing your license

To maintain your CMA license, you must keep your CPE and experience up to date. You’ll need to renew your license every three years.

To do this, you must submit proof of continuing education and take an ethics exam. You’ll also need to maintain a good track record with the Institute of Management Accountants (IMA).

If you have committed any misconduct that violates the IMA’s Code of Ethics, or if you are found guilty in a court of law for fraud or false accounting, then you can be subject to disciplinary action by the IMA, which may include fines, suspension or revocation of your certificate.

In other words, just don’t do anything shady!

Bottom Line

The path toward earning your Certified Management Accountant license isn’t easy, but it’s achievable with a lot of dedication and hard work, and well worth it.

By becoming a CMA, you’ll show your commitment to the profession and improve your career prospects.

The 10 steps mentioned in this article showed you how to become CMA, now it’s up to you to start making it happen!