If you’re planning to become a CPA then you’re probably wondering, “how long does it take to study for the CPA exam?” Generally speaking, most CPA candidates should plan to study 300-400 hours to adequately prepare for the CPA exam, meaning you should plan to spend anywhere from 80-120 hours studying for each section of the CPA exam.

These are just the averages though. How much time YOU need to study for the CPA exam will come down to your personal circumstances. You’re study habits will play a major role as well.

In this article, we’ll discuss the main factors that influence how much time you’ll need to study for the CPA exam. We’ll also give an overview of the exam, recommended hours and the top study tips for each CPA exam section!

Contents

- 1 Overview of CPA Exam Sections

- 2 Factors That Impact Your CPA Exam Study Hours

- 3 Time Since College

- 4 Depth of Work Experience

- 5 Job Status

- 6 Peer Group

- 7 English-as-a-Second Language (ESL) Candidates

- 8 Your CPA Review Course

- 9 How Much Will I Need to Study for Each CPA Exam Section?

- 10 How Many Hours to Study for the AUD CPA Exam?

- 11 How Many Hours to Study for the BEC CPA Exam?

- 12 How Many Hours to Study for the FAR CPA Exam?

- 13 How Many Hours to Study for the REG CPA Exam?

- 14 Bottom Line

- 15 Frequently Asked Questions

Overview of CPA Exam Sections

There are 4 different CPA sections you’ll need to prepare for. For more info and tips to pass each exam, check out my articles on each one:

- Financial Accounting and Reporting (FAR)

- Regulations (REG)

- Business Environment and Concepts (BEC)

- Auditing and Attestation (AUD)

Now that you understand the various CPA exam parts, let’s figure out how much you’ll need to study!

Factors That Impact Your CPA Exam Study Hours

Education History

Do the courses you take in college make a difference on the CPA exam? Maybe a little, but the education requirements to become a CPA are actually fairly consistent.

All kinds of students take the CPA exam though, and everyone learns a bit differently. If you grasp concepts quickly and didn’t need to read or take notes in college, you may be able to skip the more time-intensive parts of your CPA review course.

If that doesn’t sound like you, you may need a more methodical approach to your CPA prep. You may need to spend time reading the textbook and watching the lectures. Then, you still may need to read the textbook again to fully grasp certain concepts.

There’s no perfect way to study for the CPA exam. Follow the path that works best for you, even if it takes a little bit more time.

Time Since College

Studying for the CPA exam is a slog. However, it tends to be easier if you take it shortly after college / university. Much of the exam material will still be fresh in your head, especially if you finish with a Masters in Accountancy (MAcc) degree, since your final year will consist of several higher-level accounting courses. You’ll also have the added advantage of still being accustomed to “study mode”.

If you’ve been out of school for a while (>3 years) then it might take a little more time to study, especially on topics that you aren’t regularly exposed to at your job. Don’t worry though, as being out of school for a while can also create some advantages for you.

Depth of Work Experience

If you’ve been out of school for a while (>2-3 years) then don’t worry. You may have real-life experience with many of the subjects tested on the CPA exam.

If you work as a tax accountant, then your direct experience working with the U.S. tax code will surely help when studying for the REG exam. Likewise for FAR if you’ve worked as a corporate accountant or in a financial reporting role for a number of years.

Don’t get me wrong, you’ll still need to study. However, having direct work experience with the exam content can easily shave 30-40 hours off of your prep time.

Unfortunately, the accounting industry is very specialized. Therefore, work experience may likely only give you an edge on 1 or 2 exam sections at the most.

Job Status

As the old saying goes, “If you want to get something done, give it to a busy person.”

Most folks wish they didn’t have to juggle the CPA exam with a full-time job. However, the demands of a full-time job will simply force you to make the most of your study time.

If your only focus is on studying for the CPA exam then you’re more likely to take your time watching lectures, writing notes, taking practice quizzes, etc. There’s nothing wrong with going at a slightly slower pace if that’s more effective for you. However, the extra time can quickly add up!

Peer Group

Having friends and coworkers that are CPAs or that are also studying for the CPA exam can be a huge boost to your productivity. They know what you’re going through and can give you helpful tips and words of encouragement along the way. They may even be able to explain challenging exam topics concepts to better than your CPA review course.

Sometimes having a simple conversation with someone is all it takes to make things finally “click”.

English-as-a-Second Language (ESL) Candidates

This one shouldn’t come as much of a surprise. The CPA exam is only offered in English, but it’s an often overlooked aspect of CPA exam study time.

Most stats on how long it takes to study for and pass the CPA exam are based on native English-speaking candidates from the U.S.

This doesn’t mean that non-native English speakers do worse on the CPA exam (they don’t). If you’re still improving your English-language skills, it might just take you more time to get through your CPA review course and fully prepare for the CPA exam.

Your CPA Review Course

Believe it or not, you can pass the CPA exam using one of the best CPA review courses. However, your path to success may be much more difficult.

When choosing a review course, consider your individual learning style and choose a course that aligns with how you learn best.

Some review courses are uniquely suited for visual learners while others are better for auditory learners. Some aim to offer the most material possible, while others lean on adaptive software to streamline your studying experience and minimize your study time.

Every course featured on this site offers enough learning material to adequately prepare for the exam. Find the one that enables you to learn most effectively and stick to it.

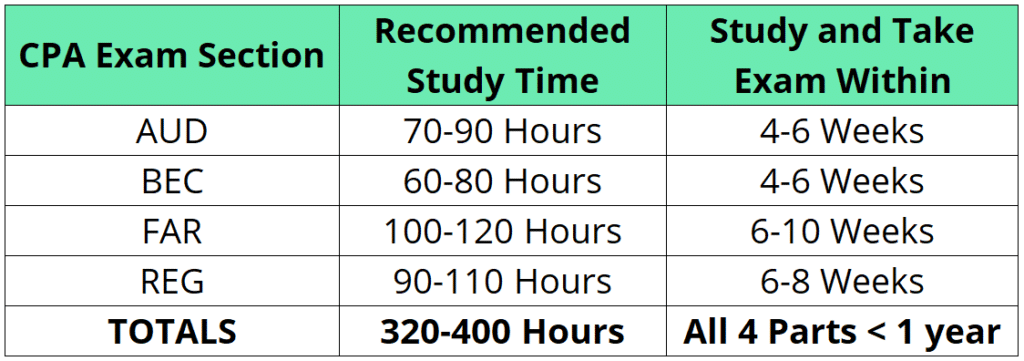

How Much Will I Need to Study for Each CPA Exam Section?

The amount of time you need to study for each CPA exam section will vary because each section covers different topics and a different volume of material.

Here’s what you need to know about each exam section to determine how much time you’ll need to study.

How Many Hours to Study for the AUD CPA Exam?

The AUD section of the exam is one of the easier sections of the CPA exam. However, that doesn’t mean it’s easy!

AUD can be challenging because it’s a relatively niche topic. Most candidates take less auditing courses in college than financial accounting, tax and business / economics courses.

Even if you’re an auditor, you’ll still need to spend considerable time memorizing audit procedures and understanding the rationale behind auditing.

Here’s what you’ll see on the AUD exam:

- 72 multiple-choice questions

- 8 task-based simulations

Given the amount of content on the AUD exam, most experts and review companies recommend studying 70-90 hours for the AUD section of the CPA exam.

TOP AUD CPA Exam Study Tips

- Pay careful attention to the wording of practice and exam questions. Answers can hinge on subtle differences in how a question is written.

- Understand the hierarchy of audit evidence and what qualifies as “sufficient” evidence for each financial statement area / process.

How Many Hours to Study for the BEC CPA Exam?

Many consider BEC to be the easiest CPA exam section, and the historical pass rates certainly support that theory!

BEC covers less material than the other exams. This exam section mostly focuses on general business topics like economics and working capital analysis. It also covers more traditional accounting subjects like cost accounting and internal controls.

Finally, BEC tests your knowledge of several common financial ratios. These tend to be easier to remember than arbitrary tax laws or audit opinion letters.

Here’s what you’ll see on the BEC exam:

- 62 multiple-choice questions

- 4 task-based simulations

- 3 written-communication tasks

Despite having the highest pass rates you still need to take the BEC exam seriously in order to pass. You won’t succeed just by memorizing financial ratios, you’ll need to know how to interpret them!

Given the amount of content on the BEC exam, most experts and prep companies recommend studying 60-80 hours for the BEC section of the CPA exam.

TOP BEC CPA Exam Study Tips

- Know your financial ratios inside and out, to the point that you could interpret and explain them to someone else

How Many Hours to Study for the FAR CPA Exam?

FAR is widely considered the one of the most difficult sections of the CPA exam. This is due to the sheer volume and range of topics covered on the exam. Even with a strong foundation in financial accounting, you’ll likely spend as much or more time studying for FAR than any other section.

FAR generally covers everything that would be included within a set of financial statements. Every main balance sheet and income statement account, the statement of cash flows, statement of equity, notes to the financial statements, and more. None of these individual topics are particularly difficult, but remembering everything is nearly impossible. The key is to stay sharp enough on most of the material to give yourself the best chance of passing.

Here’s what you’ll see on the FAR exam:

- 66 multiple-choice questions

- 8 task-based simulations

Given the breadth of content covered by the FAR exam, most prep companies recommend studying 100-120 hours for the FAR section of the CPA exam.

TOP FAR CPA Exam Study Tips

- As you progress through your CPA review course, periodically quiz yourself on earlier sections. This will help the material stay fresh in your mind.

- If you didn’t take any governmental accounting courses in college (like me!), set aside extra time to study this material for the CPA exam.

How Many Hours to Study for the REG CPA Exam?

REG can be one of the more challenging sections of the CPA exam, especially if you aren’t familiar with the U.S. tax code or don’t work as a tax accountant in the U.S.

REG covers several rules and regulations within the U.S. tax code, including both personal and business tax rules. It also focuses on U.S. business structures and several areas of business and contract law that impact accounting. The volume of material covered by the REG exam is second only to FAR. For this reason, many consider REG to be the second most challenging section of the CPA exam.

Here’s what you’ll see on the REG exam:

- 76 multiple-choice questions

- 8 task-based simulations

Given the amount of content on the REG exam, most experts recommend studying 90-110 hours for the REG section of the CPA exam.

TOP REG CPA Exam Study Tips

- REG covers lots of rules, so plan memorize A LOT on this exam

- For additional resources when studying, head on over to IRS.gov and read their instructions for Forms 1040, 1120 and 1120-S. Sometimes reading something presented in a different way is all it takes to finally “click”

Bottom Line

So, how many hours will it take YOU to study for the CPA exam?

Even with everything working in your favor, you’ll still need at least 280-300 hours to study for and pass the CPA exam. The range and volume of material covered by the entire CPA exam section is huge. Mastering it will require time to practice reading and answering multiple-choice questions and simulations correctly in a timed environment. Realistically, you should set aside more time that.

Time spent isn’t everything though. The quality of your studying is just as important, as is the consistency in your study plan. Crushing out 150 study hours for FAR won’t work if you drag it out over 6 months and skip practice quizzes.

My recommendation: As you chart out your own exam schedule and study plans, plan to complete the suggested number of hours within the following time frames for each section of the CPA exam:

Also, remember that things come up and you may have to adjust along the way. If possible, add 1-2 weeks of buffer time into your prep schedule for each exam. This will help you deal with any surprises that come up along the way. You’re better off having a little extra time at the end for final review than be forced to cut corners and fail.

Remember, the CPA exam is designed to be difficult, but not impossible. If it was easy then anyone would be able to get their CPA license. You’re not just anyone though, otherwise you wouldn’t be here.

Frequently Asked Questions

This will depend on lots of factors, including whether you have a full-time job and your timetable to pass the exams. However, most CPA exam candidates should expect to spend 15-20 hours per week on exam prep.

If you’ll be studying on a full-time basis, it’s possible to pass the CPA exam in as little as 3-6 months. However, given that most candidates also have work commitments, the entire process can take 9-15 from start to finish.