Before diving into the CPA evolution and exam changes coming in 2024, let’s examine the current structure of the US CPA and the prevailing CPA exam sections.

The CPA credential is the apex professional qualification in public accounting and finance in the country. The CPA qualification is awarded by the American Institute of Certified Public Accountants (AICPA). Eligibility to sit for the CPA exam is not uniform across the U.S., but the exam content is identical.

In the current structure of the exam, a candidate needs to clear 4 papers. The moment one is cleared the other 3 must be completed in the next 18 months. The CPA exam sections that must be passed for the CPA credential through December 15, 2023 are:

- Auditing and Attestation (AUD),

- Business Environment and Concepts (BEC),

- Financial Accounting and Reporting (FAR), and

- Regulation (REG)

CPA aspirants need to complete 150 hours of credit hours before they can earn the license. Some states allow candidates to sit for the exam with as few as 120 hours. They would then need to complete the remaining 30 hours prior to being awarded the license.

Now, let’s examine the CPA evolution model threadbare.

Contents

What is the CPA Evolution Model

The CPA evolution model is a joint effort of the AICPA and NASBA (National Association of State Boards of Accountancy).

The objective of the CPA Evolution model curriculum is to transform the model for CPA licensure to fit the fast-changing requirements of modern-day accounting practices and what is expected in the future.

New CPA Evolution Model Curriculum: Launch 2024

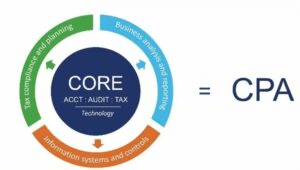

The new model is a mix of core subjects plus additional disciplines. Its foundation is grounded on a deep and strong focus on auditing, accounting, and tax and technology that all candidates must complete.

The biggest change to the CPA exam is the requirement to choose a discipline, which generally aligns with the broad career paths CPAs can take. The new CPA exam disciplines are:

- Business Analytics & Reporting (BAR)

- Information Systems & Controls (ISC)

- Tax Compliance & Planning (TCP)

As you can see, the new CPA exam disciplines align with the various career paths that most CPAs take.

Candidates need not restrict their area of practice to the discipline they focused on during their CPA exam. Each discipline will lead to full CPA licensure with privileges and rights that are like any other CPA licensure.

Core Benefits of the CPA Evolution

There are several benefits of the newly-introduced CPA Evolution model curriculum.

- It produces CPAs with the required in-depth knowledge to perform high-quality work and enhance public protection.

- The essentials of finance and accounting – tax, auditing, and accounting – are all combined into one robust common core.

- Provides deeper knowledge in one of the three pillars of the profession, reflecting the realities of the CPA practice.

- The CPA Evolution model helps to prepare the profession for the future.

Transition Policy

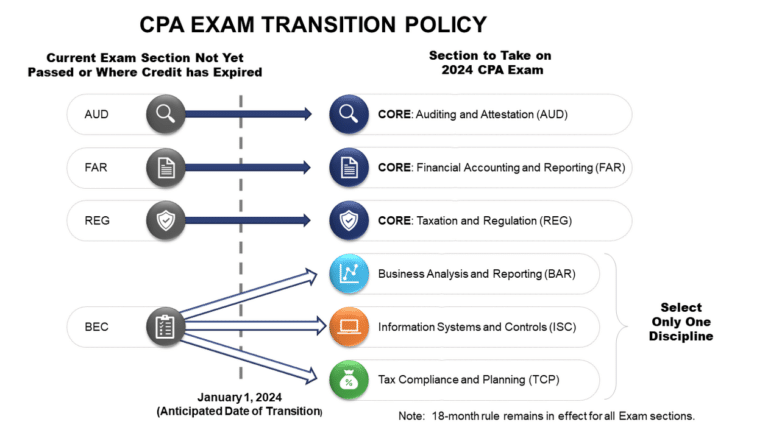

What happens to candidates who have started the CPA exam but are unable to complete it by January 2024?

Thankfully, a transition policy has been established to address students in the middle of taking their CPA exams.

Candidates who have yet to complete AUD, FAR, or REG as of December 15, 2023 will have to appear for the 2024 CPA exam in the new corresponding section of AUD, FAR, or REG.

Those who have not passed the BEC section in the current CPA exam will have to sit for any of the three disciplines. These include Business Analysis and Reporting (BAR), Information Systems and Controls (ISC), and Tax Compliance and Planning (TCP).

CPA Exam Changes 2024

The core changes to the CPA exam 2024 have been analyzed in the previous section. Now, let’s examine in detail the CPA exam evolution in 2024 and the corresponding CPA exam changes in 2024.

There are no changes to the core subjects AUD, FAR, and REG. All CPA candidates will have to clear these 3 subjects.

However, it’s expected that the levels of difficulty will change in the new CPA exam evolution in 2024. BEC is being removed and will be replaced with the 3 new CPA exam disciplines.

Summary of New CPA Exam Disciplines

- Business Analytics & Reporting (BAR): It’s an extension of the FAR core topic. The discipline is ideal for candidates who want to practice in the areas of financial statement analysis and reporting. It also covers assurance and advisory services, technical accounting, and financial and operations management. The BAR discipline content assesses topics such as financial planning techniques, financial risk management, as well as data analytics.

- Information Systems & Controls (ISC): This is an extension of the AUD core topic, with a focus on technology and business controls. Candidates interested in information systems, IT audits, information security and governance, and assurance or advisory services related to business processes would find ISC the ideal fit. The ISC discipline content is primarily related to internal control testing, IT and data governance. It also covers information system security consisting of network security, software access, and endpoint security.

- Tax Compliance & Planning (TCP): This is an extension of the REG core topic and is focused on taxation topics that involve a higher degree of advanced individual and entity tax compliance. The TCP discipline content is heavily inclined towards inclusions and exclusions to gross income, gift taxation compliance and planning, personal finance and entity planning. Advanced compliance of entity tax may include transactions between an entity and its owners, multijurisdictional tax issues, and consolidated tax returns.

CPA Evolution Transition Plan

Hence, a student can choose from one of the following three options depending upon the area of interest after the CPA exam changes in 2024.

- AUD, FAR, REG, and BAR – This path would be ideal for those having a strong inclination towards core accounting and wanting to specialize in this field.

- AUD, FAR, REG, and ISC for those wanting to have a specialization in the auditing and/or IT fields. Curriculum focuses on the latest technological advancements that facilitate the audit process in the modern automated ecosystem.

- AUD, FAR, REG, and TCP for students who have a flair for taxation and regulation and want to enhance their skillsets in these areas.

With BEC being removed from the CPA exam, students planning to pursue the CPA are wondering what to do. Candidates should aim to clear the BEC exam before the CPA exam changes in 2024 roll in.

What is AICPA Blueprint

The American Institute of CPAs (AICPA) has released the latest version of the Uniform CPA Examination Blueprints. The Blueprints are the official guidelines for content eligible for assessment on the exam. They’re based on the skillsets and professional expertise required to meet the modern demands of firms, clients, and employers.

So, how does the AICPA Blueprint align with the CPA exam in 2024?

The CPAs of today must have more competencies, higher skill sets, and greater knowledge of emerging technologies. They also must understand the impact each has on accounting, tax, and audit. To ensure that future CPAs are in control of this changing ecosystem, the AICPA and NASBA have jointly rolled out this CPA evolution model curriculum.

The AICPA Blueprint has been explained by Susan Coffey, CPA, CGMA, and CEO of Public Accounting at the AICPA in detail. In her words:

“The CPA Exam has evolved to align with a digital-driven marketplace, and that means a greater emphasis on technology and analytical skills. Through CPA Evolution, new Exam candidates will gain the skills and competencies they need to better meet the public’s, clients’, and employers’ needs. Candidates will also have the flexibility to choose their preferred area of focus within the multitude of career paths available in the profession.”

A lot of effort has been put in by the AICPA through its Practice Analysis research for aligning the CPA exam to the CPA Evolution.

The research collated inputs from various stakeholders who are committed to preserving the strength and mission of the CPA profession. They included public accounting firms, individual CPAs and boards of accountancy, businesses, government, and academia.

Summing Up

Candidates can view the full transition policy and the FAQs and webcast recordings on the website of NASBA. They must note that the last day of testing for all current sections of the CPA exam is anticipated to be December 15, 2023, since the aligned CPA exam with the CPA Evolution will launch in January 2024.