As a young or prospective accountant, deciding whether or not to pursue a certification is a big decision. Traditionally, the debate was mostly around whether or not to pursue the CPA license, the gold-standard accounting certification in the U.S. However, recent shifts in the industry are causing many young professionals to also consider the Certified Management Accountant (CMA) designation. Depending on your career goals and where you plan to work, the costs and benefits having a CMA vs CPA can vary greatly.

For this post, we’ll examine the key differences between the CPA and CMA licenses, including:

- CPA vs CMA career paths

- CPA vs CMA salary expectations

- CMA vs CPA exam overview

- CMA vs CPA exam difficulty and hours

- More!

Over the last decade, the Certified Management Accountant (CMA) designation has grown in popularity. As evidence of this shift, the AICPA and CIMA, the governing bodies for the CPA and CMA credentials, respectively, have joined forces. CMA vs CPA is the million-dollar question that candidates seeking certification in accounting have to come up against. It is a major career decision that has to be made by any accounting student. While both credentials function as accountants, the basic difference between a Certified Public Accountant (CPA) and a Certified Management Accountant (CMA) is in the approach of each branch of accounting. A CMA-certified person is responsible for cost and financial analysis and works as a management accountant and a CPA-certified person typically works in auditing and tax.

Let’s dive in!

Contents

What is a CPA?

A certified public accountant is a licensed accounting professional. Individual CPA licenses are granted by individual State Boards of Accountancy, while the American Institute of Certified Public Accountants (AICPA) provides resources required for obtaining the CPA license and establishes professional standards for the profession.

While all CPAs are primarily accountants, those who earn this credential have specialized knowledge and skills in this field.

The responsibilities of a CPA are wide-ranging and can involve such activities as day-to-day accounting and bookkeeping, producing and analyzing reports, accurately reflecting the financial performance of individuals and business where they are employed, tax reporting and filings, and more. Experienced CPAs can also serve in strategic roles guiding companies on the best course of action to maximize profitability and minimize taxes.

What is a CMA?

The CMA credential is awarded by the Institute of Management Accountants, the body that tests and administers the designation. Holding a CMA demonstrates a mastery of strategic management and financial accounting knowledge skill sets, and is increasingly seen as a viable alternative to the CPA license.

CMAs are particularly valued within corporate accounting departments. The credential makes them well suited for managing an accounting department, analyzing data to measure and optimize business performance, and much more. CMAs don’t just crunch numbers, they can go a step beyond to identify and implement business strategies too.

Those with a CMA credential have a large choice of career possibilities such as Cost Accountant, Risk Manager, Chief Financial Officer, and more.

CMA Certification vs CPA Certification

There are many differences between the CMA vs CPA certifications, particularly around the licensing requirements and exam structure.

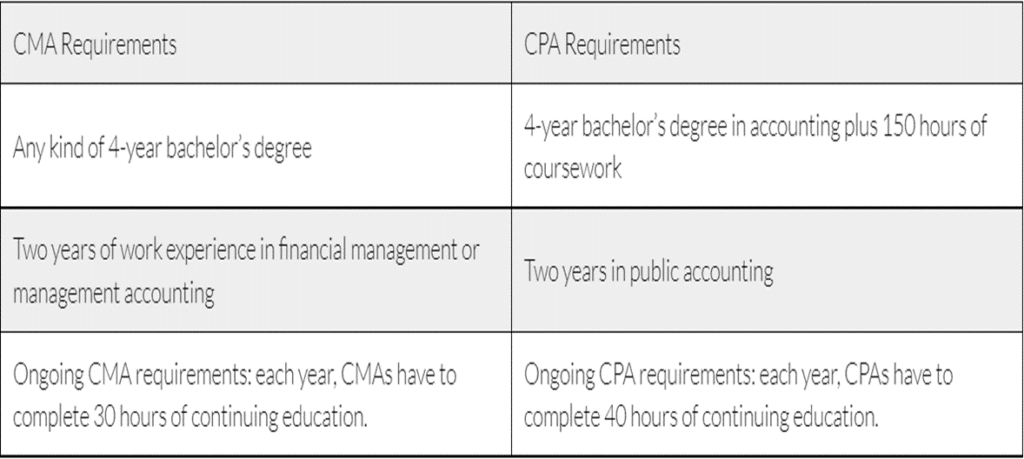

To be eligible for the CMA exam, candidates must have 4-year bachelor’s degree while for CPA, a certain number of accounting credits must be completed and candidates need a minimum of 150 semester hours. The stricter requirements often leave the CPA license out of reach for many candidates, while the CMA credential is more inclusive and is achievable for accountants with more diverse educational backgrounds.

Once licensed, CMAs have to complete 30 hours of continuing professional education (CPE) each year while CPAs generally need to complete 120 hours over a 3-year licensing cycle.

Here’s some more info comparing each credential:

CMA Exam vs CPA Exam

Now let’s look at the key differences between the CMA exam vs CPA exam.

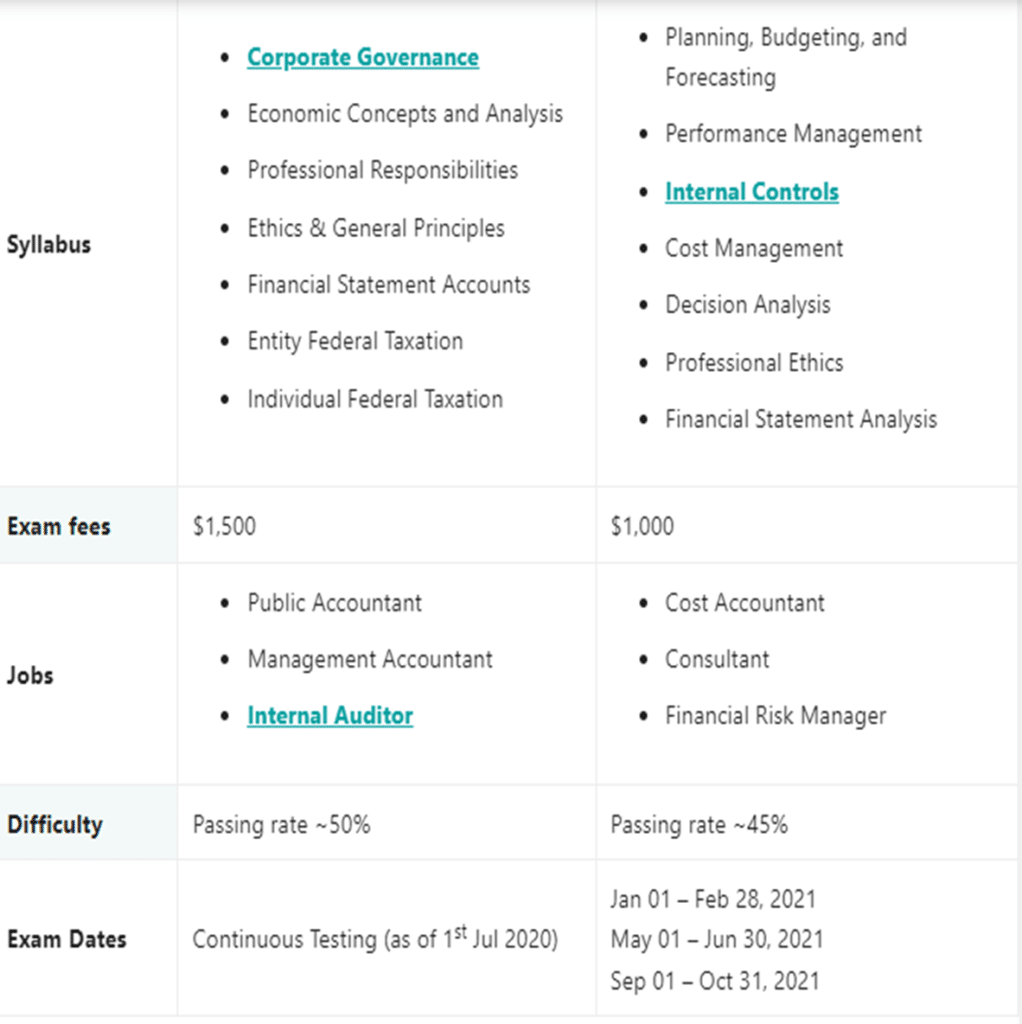

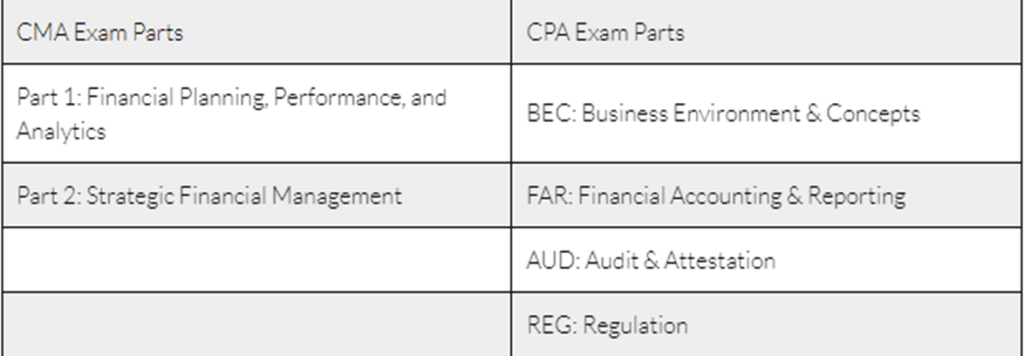

At a high level, the CMA exam consists of two parts – Financial Planning Performance and Analytics and Strategic Financial Management.

The CPA exam on the other hand has four parts – Business Environment & Concepts, Financial Accounting & Reporting, Audit & Attestation, and Regulation.

Comparing the difficulty of the CMA vs CPA exam can depend on several factors, including your own work history and strengths and weakness as an accountant.

For example, if you are already working in a corporate accounting role in management accounting, the CMA exam topics may be easier to grasp than the range of CPA exam topics. Those in public accounting may find the topics of the CPA exam to be more relatable and thus easier to study. Thus, CMA vs CPA difficulty will vary from candidate to candidate.

One way we can measure and compare the difficulty between the CPA vs CMA exams is by comparing the CPA and CMA pass rates. Historically, the CMA pass rate was roughly 45% while that of the overall CPA exams was closer to 54%. However, results for both exams have been much closer in recent years. While pass rates don’t tell the whole story, based on the raw data alone, one could argue that the CMA has been slightly more difficult to pass than the CPA.

CMA vs CPA Hours

CPA candidates have 18 months to pass all four parts of the exam, starting from when the first part has been cleared. While individual experience can vary, most candidates should plan to commit between 80-120 hours of study time for each CPA exam, or roughly 400 total hours.

On the other hand, CMA candidates have 3 years to complete the exam starting from the date of initial registration. The Institute of Management Accountants (IMA) estimates that, on average, the CMA exam can take approximately 300 hours of total study time.

Studying for the exam aside, CMAs must complete 30 hours of continuing education each year to maintain their license, while CPAs need 40 hours per year over a 3-year period.

CPA vs CMA Salary Comparison

A comparison of CPA and CMA salaries shows that a CPA license may be more valuable.

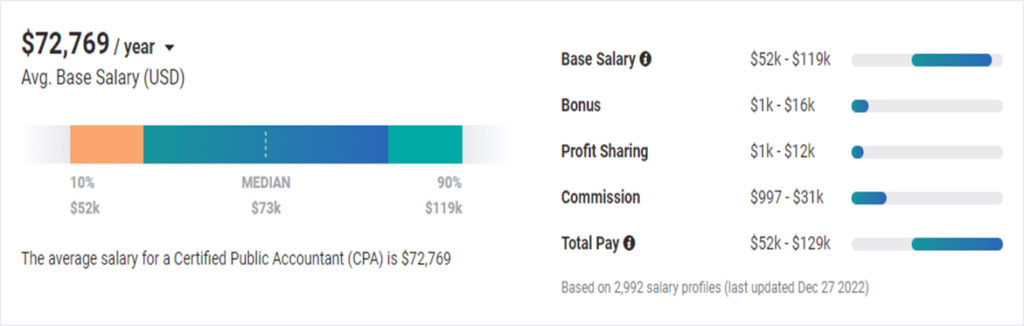

According to PayScale, median pay for CPA holders can range between $52k to $129k including basic pay, profit sharing, bonus, and commissions with the median salary pegged around $72k.

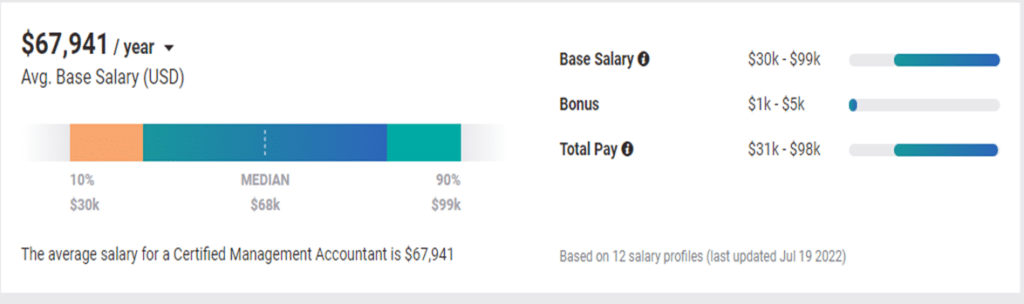

A CMA, on the other hand, can expect to rake in $31k to $98k, including bonus with the average salary hovering around $68k.

While the average CPA salary appears to be slightly higher than a CMA salary, keep in mind that the CPA license tends to be more popular in the U.S., whereas the CMA license is more common among non-U.S. based workers. Therefore, the number of CMAs used to calculate these figures is substantially smaller than the CPA salary dataset.

CPA and CMA Combination Salary

While CPA and CMA salaries are comparable, both will provide a pay bump compared to their non-licensed peers. In general, CPAs can expect to earn 15% more than those with similar experience and no CPA, whereas CMAs can expect a pay bump as high as 55% (as per IMA reports). Not bad!

What if you earn both certifications? There isn’t much verifiable data on CPA CMA dual certification salaries, but an IMA survey has shown that individuals with a CPA and CMA make on average about $132,000 per year. This is notably higher than the CMA and CPA salaries noted above. However, it should be noted that those with CMAs and CPAs may be further into their career than those with just a a CPA or CMA license.

Consequently, the salary for an accountant with CPA and CMA is more likely to be impacted by their role / position rather than having both certifications.

CMA Benefits vs CPA

To understand the CMA benefits vs CPA better, let’s look at what each one has to offer.

Key Benefits of having a CPA:

- More widely recognized and the most established qualification in the accounting field

- Higher entry barrier and difficulty makes the license very valuable

- Suitable for a range of career paths in both finance and accounting field, public accounting and industry.

Key benefits of having a Certified Management Accounting (CMA) vs a CPA

- The CPA exam and study materials can be more theoretical, whereas the CMA course is oriented around skill sets that are more practical for mid-career and experienced professionals.

- While both the exams are expensive, the path to becoming a CMA is relatively cheaper

- If you want to fast-track your career, you can take the CMA exam before graduation. However, you’ll still need to complete your bachelor’s degree and earn 2 years of experience before getting the CMA certification.

At the end of the day, both certifications are highly respected, and can boost your career prospects. However, the debate between the CPA vs CMA certification will ultimately come down to where you’re looking to take your career and the types of jobs you want to be eligible for.

CPA vs CMA Career Paths

As noted earlier, CPA and CMA career paths can be quite different.

While CPAs are well equipped for management positions, their skill sets as business managers are more or less learned on the job. The CPA exam itself does not include a substantial amount of testing over management accounting concepts the way the CMA exam does.

CPAs generally a wider range of training and can be found both in a wide variety of roles in public accounting, private business, fortune 500 companies and government. They can also go it alone and work as solo tax preparers or consultants. This flexibility is a big part of why the CPA license is so widely recognized and respected.

CMAs can work in many of the same roles and fields as CPAs, however the exam’s focus and emphasis on management accounting concepts makes the credential particularly more valuable within a corporate accounting environment.

If you’re planning to pursue a role in public accounting, handle taxes or simply want to open as many doors as possible, then the CPA license is the way to go. If you want to work primarily in corporate accounting and/or more strategic roles like FP&A, then the CMA may be a more appealing path.

CMA vs CPA for a CFO Track: Which is Better?

The job of a CFO is to understand the financial condition of the company and be in overall charge of the accounting activities including the allocation of resources. Traditionally, CPAs have dominated the CFO ranks. Today, 44% of CFOs are CPAs.

However, the CFO role is rapidly evolving and having a CPA isn’t a prerequisite for the role. Considering that a CMA is well suited for performing business analysis and deciphering financial data, the path for a CMA to become a CFO may grow over time.

It’s impossible to say if a CMA vs CPA will give you a higher chance of becoming a CFO. While more CFOs have a CPA than any other credential, it’s far better to think of the CFO career path as the set of experiences you must accumulate over your career rather than your accounting credentials.

It can take 20 years or more to finally earn the CFO post, at which point your work experience will matter far more than the letters after your name.

Which Credential is Better for You?

There’s no perfect answer to which credential is better. Ultimately, it comes down to what you’re looking to get out of your career. Be sure to research jobs and positions that sound appealing to you, and see which credentials employers are looking for in these roles.

Generally speaking, if you’re planning to pursue a role in public accounting, handle taxes or simply want to open as many doors as possible in your career, then the CPA license may be the way to go. On the other hand, if you want to work primarily in corporate accounting and/or more strategic roles like FP&A, then the CMA may be all you need.

Whichever path you choose, plan to earn your credential as early as possible before you get bogged down with a ton of responsibilities at work (or at home!). Be sure to check out our CMA and CPA exam hubs for more info on each exam and our review of the review courses available.